If you're reading this, then you're probably old enough to remember the 2008 global economic crisis It came about because financial institutions were bundling and selling poor investments and taking too many risks. Governments moved quickly to secure their economies, but the shockwaves were felt at every level of society for years afterwards.

The UK struggled through a years-long sluggish recovery before being broadsided with Brexit. So we could hardly be blamed for not noticing a quiet publication on October 31, 2009. That's the day a mysterious Satoshi Nakamoto published a white paper detailing how global financial systems could be decentralised.

Satoshi established the world's first blockchain and mined the first bitcoin. And then, they disappeared. To this day, nobody knows who Satoshi is/was (though there are contenders). But everyone agrees that blockchains and digital currencies launched a new generation of financial technology - Fintech.

Those opposing forces - the financial meltdown and new-generation fintech- happened almost simultaneously. Had they happened individually, their impacts might not have been so significant. Happening together, they revolutionised the future of banking and finance. To maintain our financial security in these changing times, we need to understand the following:

- the difference between digital and cryptocurrencies and their risks

- what the dangers of financial fraud and crime are

- what open banking is, and what fintech has to do with open banks

- where these new policies and technologies will take us

As I write this, the US is days away from defaulting on its financial obligations; negotiations are going nowhere. Does that mean we're in for another 2008 crash? What do we need to know to protect ourselves and our finances? With those concerns in mind, we lay out the future of finance and banking.

Fintech and Open Banking

Fintech, for all its glitzy, modern, techie-sounding name, is almost 200 years old. In 1837, William Cooke and Charles Wheatstone established the first UK telegraph system. In the US, Samuel Morse and Alfred Vail set up the first single-wire telegraphy system. Those early distance communication initiatives soon became a means to 'transmit' currency and transfer orders from one bank to another.

Thus, fintech was born but it took until the 1980s for anyone to describe it as such. Sunday Times editor Peter Knight coined the term to describe a pesky bot that was interfering with his mail. The word didn't catch on outside of finance publications until after the 2008 crash, though. That's when venture capital firms started pouring money into fintech startups.

For centuries, banks have had complete control of the financial realm. The Medici family in Italy established the first 'modern' bank to bypass royal and religious constraints on money flows. Shortly afterwards, the Republic of Genoa opened the world's first state bank. Thus, banking was democratised.

Banks don't just manage finances, though. They also have access to clients' personal data: how much money they have and what their spending patterns are. Before long, early banks amassed a staggering amount of information on their customers. Banks' collection and assessment of private data continue to this day.

Imagine the damage such an information leak could cause! Bankers caught on early that they were keepers of trust. To maintain security, banks walled themselves in, sharing only the information needed to make transactions.

The combination of complete control and complete secrecy galls fintech investors. They rightly believed that lack of transparency permitted the 2008 financial crash. Worse than that: banks had a monopoly on financial products. Those institutions had no incentive to change the system as it was.

Fintech investors aimed to promote competitiveness among financial institutions. Their drive for change was meant to spur innovation. Fintech could give banking clients more access and flexibility to use their funds to their advantage. Above all, fintech ended the stranglehold banks had on the finance industry.

Fintech and open banking are the future of financial services. Each client may select the fintech platform that suits their needs and manage their financial affairs as they see fit. Banking clients may move money between accounts, use scan-and-pay features and even track their investments.

Digital versus Cryptocurrencies

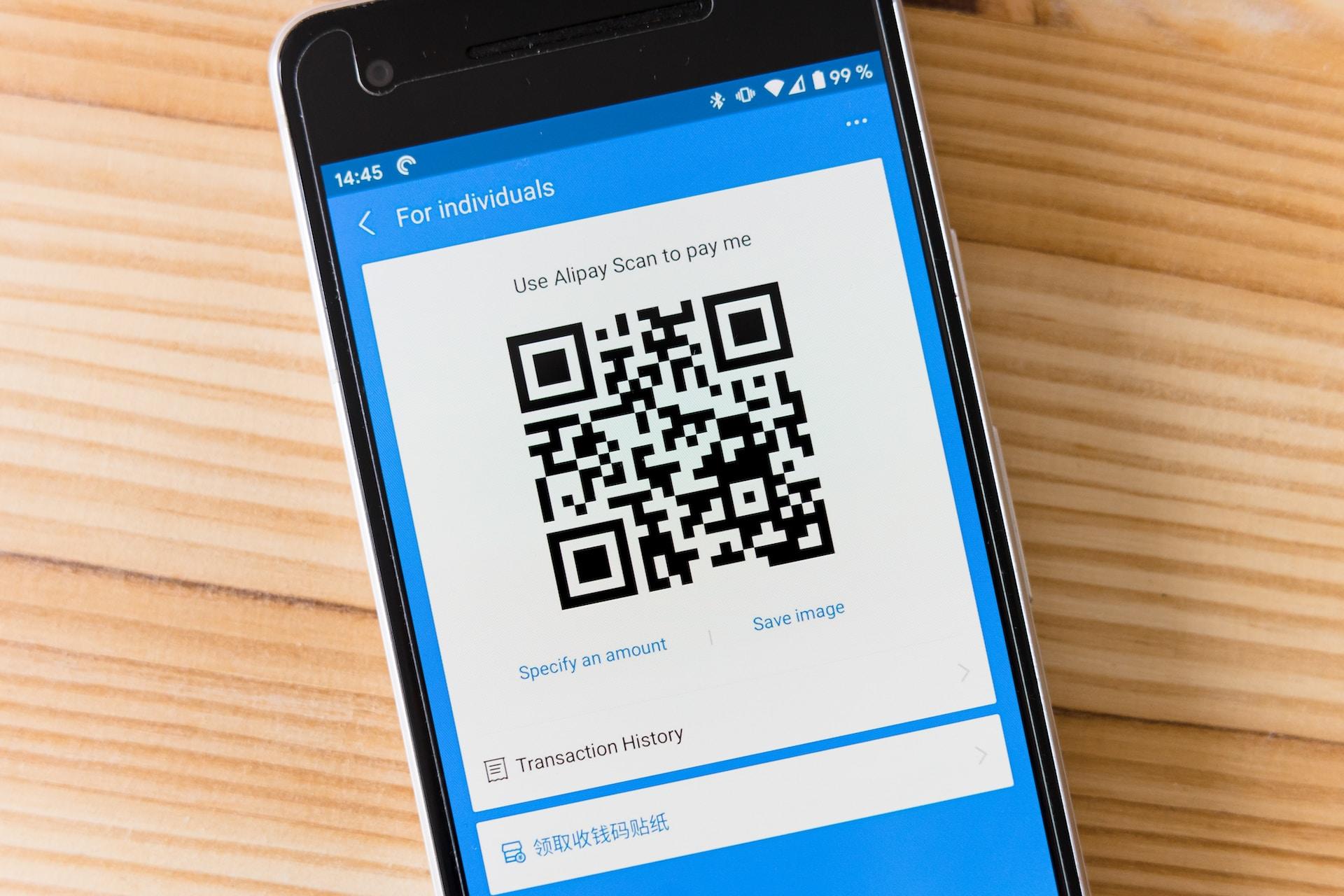

So far, China is leading the way both with open banking and central bank digital currency. Tech giant Alibaba launched its mobile payment system Alipay in 2003; Tencent debuted WeChat Pay in 2016. To date, both platforms support financial activity for millions of users.

With their open banking initiatives so successful, the next step was for the Chinese central bank to launch a digital currency. The initial market test took place in 2019 via a lottery in the city of Suzhou. The initiative was a resounding success. In 2021, China started public-testing the digital renminbi (RMB).

This digital national currency's most intriguing feature is that it can be decoupled from the banking system. Let's say you're headed to China for the holiday of a lifetime. Your travel agency advises you that mobile payments are standard, but you worry your data won't be safe if you use fintech. Rather than downloading a Chinese mobile payment app, you can use decoupled RMBs to pay for everything.

China's central bank digital currency is based on cryptocurrency principles. It is wholly digital; you can't make a cash withdrawal of digital RMBs. The main difference is that cryptocurrencies 'live' on a blockchain - a decentralised ledger. They are not state-issued fiat currency like this digital currency is.

Other countries are at various planning stages for their state-issued digital currencies. A few, including the UK, want to explore blockchain-based digital currencies. Other nations are still debating whether traditional bank structures should underpin the digital currency. Researching digital currencies is a top financial tip to follow because they will be a part of your financial future.

Financial Crime

With everyone's data floating around cyberspace and stories of hackers ever more frequent, your data being stolen is a legitimate worry. But only until you learn that your information and financial assets are likely more secure. Fintech provides layers of security to keep bad actors away from your data and finances.

Without getting too deeply into the technical details, fintech and open banking use application programming interfaces (APIs). APIs form a direct channel from your bank's computer to your chosen fintech platform. APIs usually consist of several different parts that don't all have to work at the same time. When you access your fintech, the platform 'calls' a portion of the API to execute its specific function.

From that oversimplified description, you'd be right to guess APIs keep your data and money safe. The banking industry may have relinquished its monopoly on the financial sector but they still maintain their mandate to keep clients' data safe. In that sense, the phrase 'open banking' gives the wrong impression.

Blockchain and cryptocurrencies are also safe but they're not impervious. In theory, it's impossible to hack a blockchain but that hasn't stopped bad actors from making away with billions worth of assets. Bad actors tend to target cryptocurrency exchange platforms because they are the easiest access points.

Finance and Banking in the Future

Any financially literate person would be wary of cryptocurrencies. The technology's promise is amazing but has yet to be realised. The banking industry, along with governments around the world, will likely prefer digital currencies issued by central banks. That way, they can stay on top of how much money is floating around their economy.

By contrast, blockchain technology is finding ever more uses. Currently, the European Union is building a citizens database to ensure proper data storage and accessibility around the bloc. Work on their pan-European public services blockchain has already begun. It will allow any Schengen-area resident to access healthcare and other social services wherever they happen to be.

If China is anything to go by, the future of banking and finance is cashless. For decades, governments, commerce and industry have traded in zeros and ones. No bits and bytes for the common consumer, though; bills, coins and cards fill our wallets. That may be the case only for another ten years or so.

Physical currency has long been the way to regulate consumer activity. Bankers functioned as gatekeepers, extending credit only to worthy supplicants. In the 1960s, credit card companies expanded consumer buying power, but only so much. And usually for a fee.

The world of consumer finance is about to get a lot more democratic. With fintech, banking customers can make financial decisions without oversight and with fewer restrictions. They may move money from checking to savings, and take advantage of investment opportunities. Their open banking app may even have a budgeting tool to help them keep track of their spending.

If they want to start a business, they can request funding without having to fill out lengthy applications or provide justification. Such a request might go to a bank or the government's small business office. Upon approval, the government would transfer the funds to the bank so the new business owner has quick and direct access. Efficiency defines the future of banking and finance

Summarise with AI: