Often, the mere mention of subsidies is enough to raise peoples' hackles because most taxpayers believe that tax revenues should not go to support businesses or offset their operating costs. There is some merit to that claim. It's hard to understand why corporations receive subsidies when they earn millions in profit every year.

Likewise, some hard-liners believe that the economically disadvantaged shouldn't be subsidized, either. Why should they get free money while the rest of the world is hard at work, earning their keep?

These contentions, while understandable, overlook the fact that not all subsidies are the same. And, though their purpose remains the same across the board - keeping the economy balanced, how and why they're administered, and to whom, depends on the type of subsidy.

| Types of subsidies; |

|---|

| Production subsidies encourage increased output so goods can be priced lower. |

| Employment subsidies provide incentives for companies to hire and train more workers. |

| Transport subsidies help cover public transportation costs, particularly for buses and trains. |

| Oil subsidies meant to keep fossil fuel prices low. However, a renewed focus on climate change has caused many countries and the IMF to wind such programmes down. |

| Housing subsidies help families secure financing to buy homes, and allow them to deduct mortgage interest and stamp taxes, among other incentives. |

These are just a few types of subsidies and who they're targeted; there are plenty of others. And, to make matters more confusing, there is more than one way to categorise subsidies.

So, before we highlight the different types of subsidies, let's talk about how they are grouped.

Broad, Narrow and Perverse Subsidies

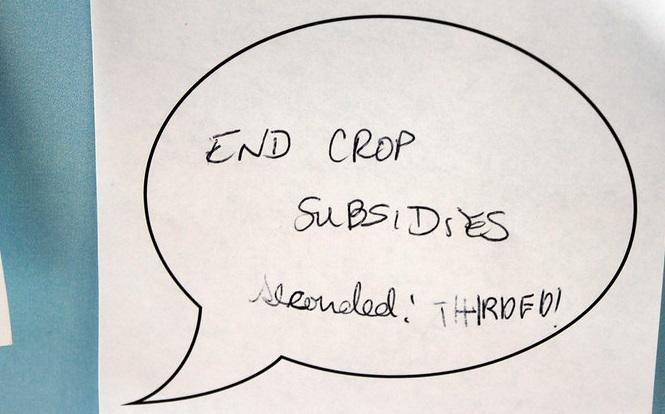

We'll start with narrow subsidies because they're the easiest to understand. A narrow subsidy is usually in the form of money; a targeted and identifiable payout. Agricultural subsidies are a perfect example of such a subsidy. This is money that farmers are given by the government to cover their operating costs, as well as to remediate their land and cultivate sustainable initiatives for land usage.

By contrast, a broad subsidy is not as easy to trace, nor is it always in the form of cash. To give you an idea of how complex they are, let's talk about carbon capture and cap-and-trade schemes.

The climate crisis is growing ever direr but we don't yet have a way to lower emissions without severely impacting our current standards of living and production. As a stopgap measure, governments have proposed various schemes, such as capturing and storing carbon emissions, or cap-and-trade that would provide economic incentives to reduce pollutant emissions.

These subsidies are known as environmental externalities; they fall under the banner of broad subsidies. Tax relief, one way these externalities are compensated for, may be given to corporations for other reasons, too. They are all another type of broad subsidy.

In this categorisation system, the final subsidy is the one that everybody is upset about: the perverse subsidy.

In theory, most subsidies are not meant to be ongoing; they're supposed to bridge a specific economic gap or correct an imbalance. Once the need for subsidy is passed, payments should stop - but that doesn't always happen. At that point, the subsidy becomes perverse.

Perverse subsidies create negative unintended consequences for the environment and economy. Oil subsidies are a great example of perverse subsidies because pouring money into research and development of new wells and products runs counter to the need to pivot to sustainable, renewable energy sources - an area where oil subsidy monies could be better spent.

Furthermore, oil exploration and the fossil fuel industry have done demonstrable damage to the environment; not just because of pollution but from oil spills and groundwater contamination.

Unfortunately, perverse subsidies are not handled as decisively as they could or, indeed, should be. Fortunately, many governments are considering alternatives to subsidies to get these bad actors off the government rolls.

Legal, Illegal; Ethical and Unethical Subsidies

You would think that, as the government is usually the entity that doles out subsidies and also the body that makes laws, every subsidy would be legal. Unfortunately, that's not always the case.

Take the Boeing-Airbus case from a few years back. Under suit by the US, the World Trade Organisation had found that the EU had paid billions in illegal subsidies to Airbus, undercutting the US corporation's competitiveness in the market.

Illegal subsidies can have dramatic and far-reaching consequences. To wit, in the Boeing case, the US planned to retaliate by applying tariffs to select EU imports. But illegal subsidies don't always escalate, nor are they necessarily newsworthy.

For instance, Germany is currently under scrutiny for keeping airports open that lose money. Because those facilities are a part of the transportation infrastructure, they qualify for subsidies even though they play only a minor role in passenger transport.

Keep in mind that it's not illegal to have an unproductive enterprise; only taking public funds to keep such enterprises running is considered illegal - not in a criminal sense; in a moral sense.

Equally interesting are unethical subsidies; one of which we've already talked about. Monies for the fossil fuel industry are now generally considered unethical in light of the climate emergency and how resistant the industry is to change. Other subsidies that might be considered unethical are research grants given to studies that involve animal trials or harming the environment.

On a broader scale, any product whose manufacture was subsidized, that later enjoys worldwide distribution might be considered unethical if it undercuts or disadvantages manufacturers in those markets.

It's difficult for the average concerned citizen to determine what might be an illegal subsidy but there's no doubt that anyone could spot an unethical subsidy. Watch groups and popular movements raise our awareness of these issues and, fortunately, governments are beginning to take action.

Consumer Subsidies

Admittedly, most government subsidies are allocated to producers - manufacturers, businesses, farmers and so on. Still, there is a small number destined for consumers, to help boost their economic standing.

Housing and public utilities - gas, water and electricity are perhaps two of the most high-profile consumer subsidies; they benefit everyone at all economic levels, not just the disadvantaged. If you buy a home, for example, you may get a tax credit on your mortgage interest. Other programmes, such as council housing and rent relief schemes provide consumers with the aid they need to remain housed.

Healthcare is another area of consumer subsidy; if a patient has a long-term, severe health condition, the government might subsidize all or a part of their care, including any medical equipment they might need. Education can also be subsidized, particularly higher education. These subsidies come in the form of grants, which are often based on need rather than academic performance.

Unlike educational subsidies, most consumer subsidies are not paid directly to the consumer; rather, they are evidenced in lower prices or rates those consumers are expected to pay.

Still, regardless of whether consumer subsidies are given in cash grants, lower prices or tax rebates, they all have the same effect on the economy as producer subsidies do.

Producer Subsidies

All economic activity requires at least two parties; those who produce and those who consume. Isn't it odd, then, that the lion's share of subsidy money goes to production rather than being evenly distributed between producers and consumers?

To be fair, some production subsidies do benefit consumers directly, such as those subsidies that keep food prices stable or that provide public transportation. Employment subsidies, and monies paid to corporations to create more jobs also benefit consumers. It's much harder to consume when you have no money to spend, after all.

Nevertheless, a substantial portion of subsidy monies goes directly to producers that are of no immediate or obvious benefit to the consumer. Giving companies tax breaks is a case in point.

It would seem more to consumers' advantage for companies to pay their fair share in taxes; doing so would make more money available to pay for social programmes like healthcare and education. One reason why companies aren't held to their full tax burden is to entice those concerns to stay where they're at - rather than moving offshore, where they might enjoy lower labour and operating costs.

Experience shows that such corporations might get paid to stimulate their new operating base's economy, rather than ours.

Tax breaks such as those, as well as low-interest government loans are called indirect subsidies. They are difficult to qualify and even harder to keep track of; for those reasons and others, they tend to distort the economy and may cause economic instability.

Other examples of such subsidies include:

- manufacturing subsidies that benefit some companies over their competitors

- sports subsidies, especially those that favour one activity or club over the others

- import subsidies lower the price of imported goods at the risk of disadvantaging local producers

- export subsidies help to offset the balance of payments between trading partners

- subsidies for fisheries, particularly indirect financial transfers and other services

Note that, while direct payments to fisheries and farmers are not as hard to justify, others, such as export subsidies are actually rife for cheating. As Adam Smith so long ago declared, those concessions serve the exporter more than the economy, making the concept unsustainable from an economic perspective.

Indeed, the fact that, over time, subsidies become unsustainable - they eat far too deeply into nations' GDP, coupled with the fact that they distort the economy raises the question of whether subsidies are properly thought out and managed.

But that's not our question to answer.

Now that we know the types of subsidies available and a bit about their purpose, let's go on to discover what subsidies are.

If you're in school and you seek past papers for A-level Economics, check out this article from this series.

Summarise with AI: