"Good teaching is more a giving of right questions than a giving of right answers." -Josef Albers

Teaching is an art that must be honed. The most experienced educators will tell you that a lot of the instruction necessary to become a successful teacher is learned with the students daily. The more expertise acquired and years on the job, the more passionate you are about education.

While some teachers remain glued to the traditional classroom for their careers, there are alternative teaching positions for educators in different sectors. Such as? Well, it's worth stating that various instructors have tried private tutoring to see if they like it.

Private tutoring is enjoyed by professional teachers since not only is it an opportunity for them to supplement their income, but it's also engaging and diverse since you can teach many types of students of all ages. Nonetheless, before teachers embark on personal tutoring, it's worth stating that there is something to consider. Like what? Turnover declarations and the tax frameworks that private tutors must follow.

Without further delay, in today's article, we'll take a glance at the tax rules that freelance instructors in the UK must follow to avoid any unfortunate situations with the law!

What are Turnover Declarations?

Before getting started discussing how tutors should pay taxes according to the frameworks that have been established by Her Majesty's Revenue and Customs (HMRC), it's essential to analyse a significant part of the world of taxes known as turnover declarations. So, what are turnover declarations?

In simplest terms, a turnover declaration is a financial document that must be filled out by persons living in the UK to tell the government the actual value of a person's insurable sales. The HMRC uses turnover declarations to calculate the actual premium due for the previous year of taxes.

Turnover declaration forms are used by self-employed workers in the United Kingdom that need to claim their revenue to the government to be eligible for any tax credits and pay the income tax they owe for a given year.

A turnover declaration is similar to a profits declaration since it lets the government know how much a business has made or profited in a year. However, if a person is self-employed, they are considered their own business, and they must follow the regulations established by the HMRC to present their turnover declaration.

Failure to successfully present turnover declaration may result in financial problems for privately-owned companies and freelancers who wish to tutor for the following years. Therefore, to better comprehend turnover declarations as a private tutor in the UK, we recommend contacting a representative from the HMRC or hiring a tax tutor on Superprof.

Find out how to teach English online here.

Do Private Tutors Need to Pay Tax in the UK?

There's no way of avoiding it. If you're a working individual over the age of 18, you will have to pay taxes to the HMRC in the UK. Unfortunately, all private tutors in the UK must pay taxes regardless of the topic.

While the tax framework for self-employed individuals is quite different from salaried employees, the concept is the same: taxes must be paid. Salaried workers have taxes taken off their paycheck week after week; however, self-employed freelance tutors work towards their self-employed earnings.

Nobody is paying taxes on what they earn while we earn it; this is known as PAYE.

The self-employment tax established by the HMRC in the UK is mandatory for all persons who have made income working for themselves in a given tax year. The tax must be paid because if there are records that you made money and hadn't declared it, you will be in serious trouble with the HMRC!

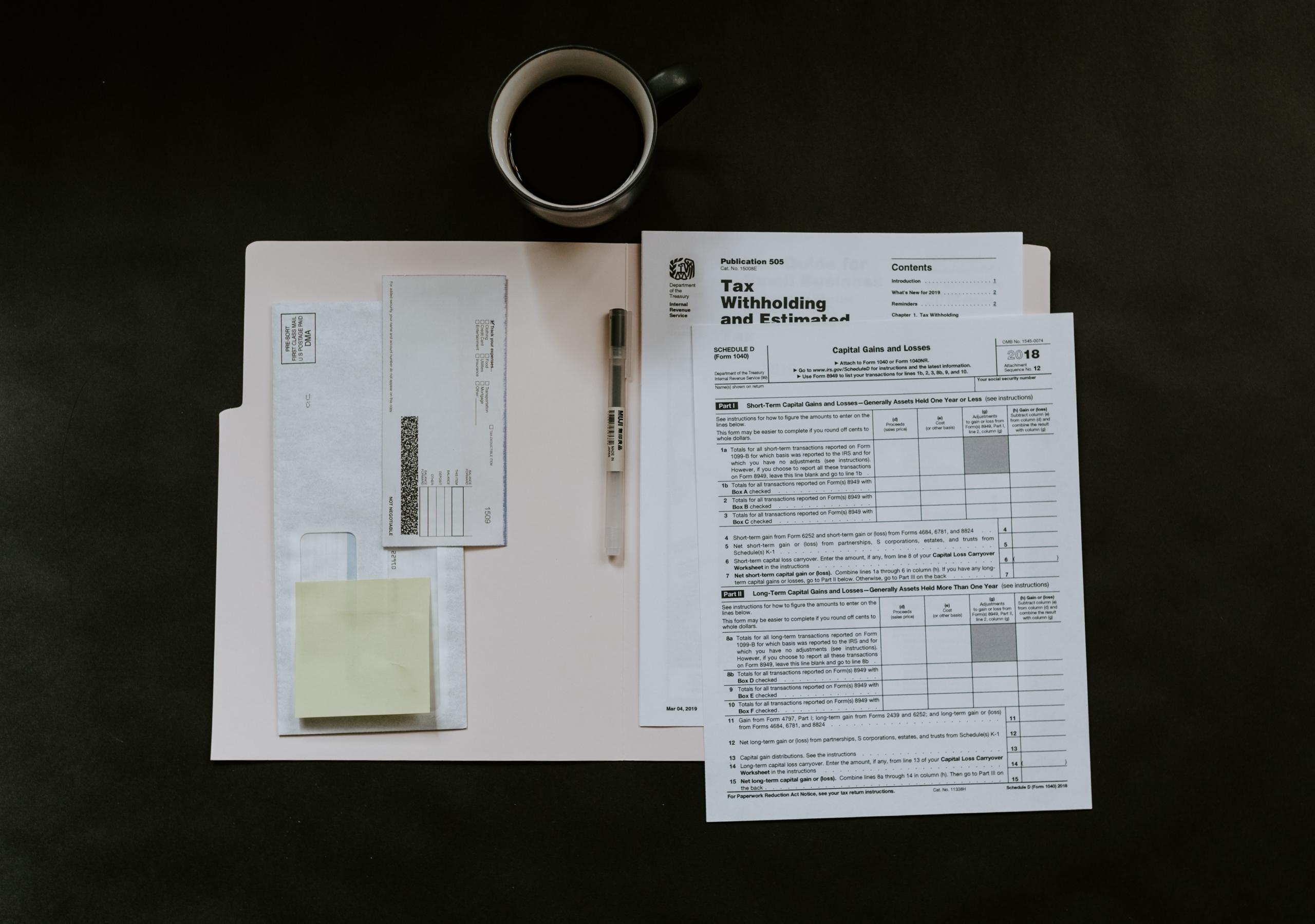

After glancing at your latest tax form that is sent by mail or seen online, there are some steps you should implement. Such as? Take a look at the following subheading to find out!

Search tutoring jobs London on Superprof UK.

How to Pay Taxes as a Freelance Tutor in the UK?

Since there is no handbook given to tutors about paying taxes when they start conducting classes, it's essential to search for tax-paying information on sites such as Superprof.

Without further delay, the following are a few necessary steps that all self-employed tutors in the UK must follow to pay for their taxes effectively:

- Declare Your Self-Employment Income: it doesn't matter if you're only teaching a few hours a week or a full-time academic instructor; you will need to declare your income to the HMRC. Revenue can be reported using a form that is downloaded online, and that must be filled out. The paper is short, and the questions are straightforward. Creating and registering for your own "small business" is highly recommended since you are the sole trader.

- Keep Every Paper: whether you think it's necessary or not, it's incredibly vital to keep all your receipts, notes, and invoices. This ensures that you know how much money you earn as a tutor and how much money you spend on things for your self-employment business.

- Organise Your Documents: if you're a popular tutor, you'll have a lot of invoices and receipts to keep track of. Therefore, from the get-go, it's a wise idea to organise your documents in a folder not to get too lost when everything needs to be calculated at the end of the year.

- Read Everything: to avoid getting taken advantage of or to ensure that you are receiving all the necessary tax breaks, it's essential to read every document that you are sent and check it over. By knowing the rules and the tax laws, you'll be better prepared to make intelligent financial decisions as a self-employed tutor.

- Keep Track of Everything: you might want to invest in an organiser to guarantee that you aren't missing any critical tax dates, past invoices from clients, and receipts that need to be sent out. In addition, there is some accounting software that helps self-employed workers keep track of everything more easily.

It's worth stating that if you're working as a subcontractor or freelancer for a tutoring company that the HMRC closely regulates, your employers will most likely send you tax papers to sign or fill out.

Also, if you own a tutoring company, you will pay self-employment tax and be required to pay VAT on the commission that you received.

Are you still struggling to understand the concepts of paying taxes for private tutoring? If so, you'll enjoy the following subheading that features some helpful tips and tricks for freelance tutors.

Find teach English online here on Superprof.

Tips and Tricks to Successfully Pay Your Taxes as a Tutor

Dealing with taxes and government entities who oversee annual income can become an absolute nightmare if not taken care of in the right way. Therefore, to avoid intense heartache from the beginning, we highly recommend closely heeding the following tips and tricks:

- Ask for Help: are you confused about what you should be doing when paying self-employment taxes? If so, you should call up a friend who has many years of experience as a tutor. They will be able to guide you through the dos and don'ts of filing your taxes for the HMRC. Don't feel ashamed to ask for help since you might be of assistance to another new tutor when the opportunity arises.

- Hire Someone for Assistance: since the world of taxes is a highly confusing place that is constantly changing, it's no surprise that countless professionals work daily with tax laws. Therefore, it's in your best interest as a self-employed tutor to hire someone who knows what they are doing. In addition, we recommend enlisting a private tutor who knows a bit about taxes or an accountant to help you get a better idea of what is going on.

- Put Money Aside: instead of being surprised at the last minute when taxes are due, we powerfully suggest putting aside money in a savings account to pay for the self-employment tax when the time comes. Some experts estimate putting away between 15-20% of their annual income in savings to pay for end of year taxes.

By considering the previously mentioned tips, you'll make wise decisions when it comes down to paying your taxes at the end of the year.

In conclusion, we sincerely hope that our comprehensive article was enough to instruct self-employed tutors about the tax laws that are put into place for freelancers in the UK. While no one enjoys paying their taxes, if you're prepared ahead of time, you won't despise the experience as much since you'll be ready to tackle any last-minute surprise!

Find more jobs for ex teachers here on Superprof.

Résumer avec l'IA :