From a financial perspective, we have a lot of turmoil. People are having a hard time affording food, heat and petrol. Many are finding out their money doesn't go as far as it used to in the most painful ways possible. We're still hearing lots of talk about inflation, too.

But economic reports show that inflation is down from its October 2022 high. How come our prices are still climbing? What's this about interest rate hikes and rising unemployment? And how will developing global events impact our wallets?

As though that weren't enough, we have yet another financial novelty to grapple with. Talk of Central Bank Digital Currency (CBDC) is all over the place and the Bank of England (BoE) remains cautious in its projections about launching one. Meanwhile, social media doomsayers are having a field day as they present the most ominous CBDC talking points and what it might mean for your money.

These are trying times and the prospect of anything messing with our money is scary. But as always, informing yourself is the best way to overcome fear and uncertainty. You can find lots of information about CBDCs online but much of it ranges between hedging and terrifying. That's why Superprof wants to:

- clarify the language around finance and CBDCs

- explain CBDCs' goals and how they work

- point out CBDCs' good and bad aspects

- discuss the financial and economic issues CBDCs might resolve as well as some it may create

As we progress through our topic, we'll address some of CBDC doomsayers' contentions. These presenters raise valid points - let's get that on the table. But not in a way that could help you decide whether CBDCs are a net good or something to fear. Now, with our goals laid out, let's get into the meat of things.

Defining CBDC

Before we start, we must clear up a common mistake. People often use the word 'money' to mean the notes and coins we exchange for goods and services. Those tokens only represent money; they have no intrinsic value. More specifically, we all agree that those tokens represent the value that's printed/engraved on them.

These tokens flow from our wallets to merchants' cash drawers and from employers' vaults to employees' bank accounts. This 'condition of flowing' gives 'currency' its name. That's what we use to pay for goods and services.

By contrast, the term 'money' represents assets that have real value. Money is a store of value and a unit of accounting to measure the value of other things. In the UK, our unit of accounting is the pound sterling.

A digital currency has no value and cannot store value. This is why digital units of accounting are called currencies, not money. From here out, we'll refer to these tokens as currencies. With that clear, let's move on.

CBDC vs Cryptocurrencies

After years of media hype about cryptocurrency investment, you might wonder if we're trying to mislead you about digital currencies having no value. That's one of the fundamental differences between an independently launched cryptocurrency and a Central Bank-issued digital currency. Let's compare them.

Central Bank Digital Currency

- Centralised - issued by the Central Bank

- They represent the same value and denominations as physical currency

- You cannot buy CBDCs

- They don't require a blockchain environment

- They are considered safe, stable and universal

Cryptocurrency

- Decentralised - not issued by an official entity

- Their value is subject to market influences and investor sentiment

- Buying these tokens is the only way to have any

- They require a blockchain environment

- They are volatile and require specialised knowledge to access and use

You have to hand it to whoever comes up with the clever names. When first proposed, Brexit had quite the ring to it. Now we have Britcoin, a nifty play on a renowned cryptocurrency, to identify our digital pound. But that's where any similarity to cryptocurrency ends.

The digital pound is exactly that: a digital representation of our current currency units. It is a government-issued legal tender used to settle debts and pay for goods and services. This digital sterling, as it's also called, is set to play a pivotal role in our pound sterling's future.

Types of CBDCs

Throughout the financial sector, you'll find a division between commercial and retail banking. One is for banks to use for their massive transactions; retail is the type of banking you and I do. The same division will exist for CBDCs but with a slight name change: retail for the general public and wholesale - instead of commercial, for the banks. Both sectors' principles and functions will remain the same.

What CBDCs Aim to Do

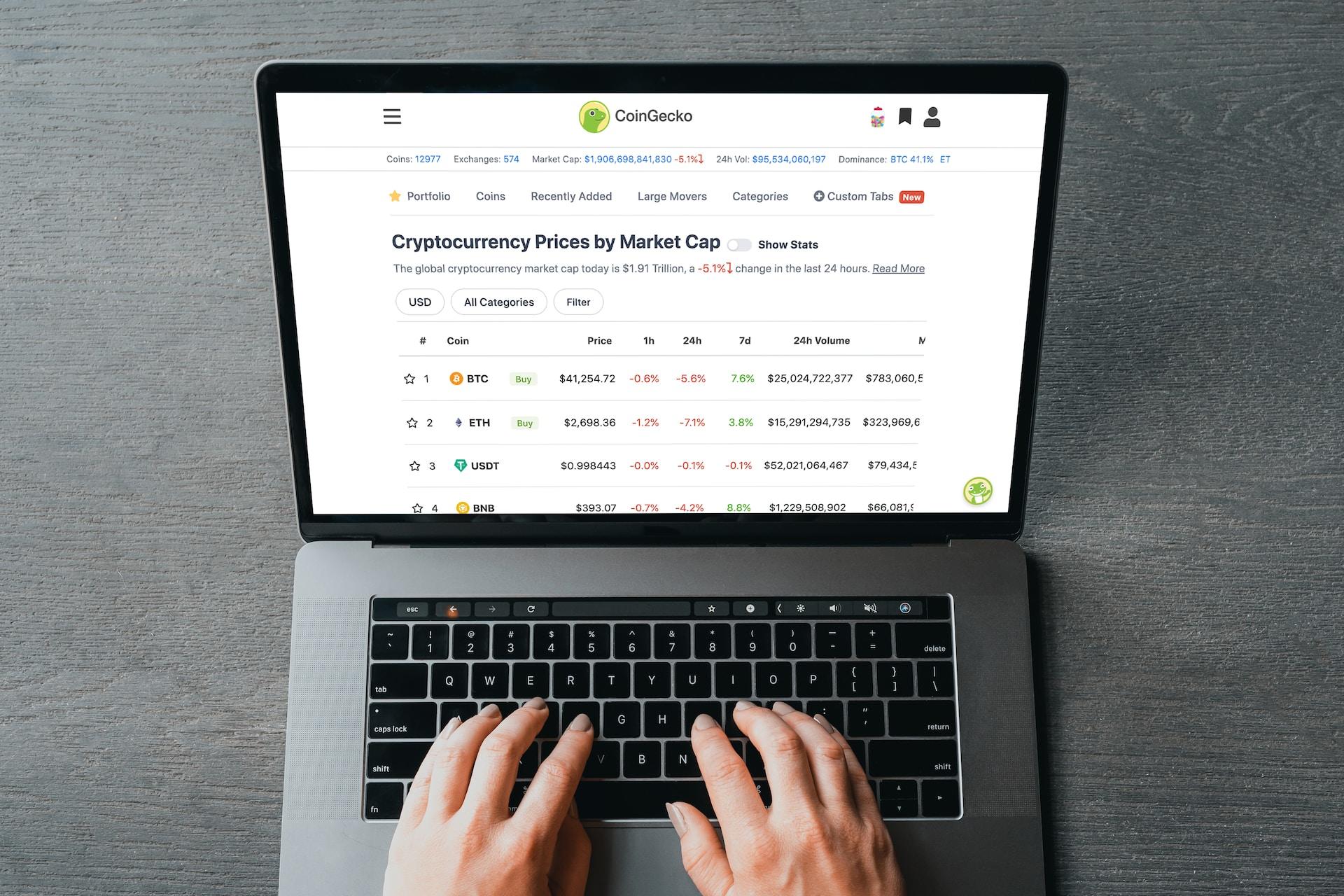

Many countries are exploring CBDCs' potential; these currencies represent a natural evolution in financial policy. Technology made the concept possible but these new initiatives have cryptocurrencies to thank for their beginnings. (Photo by Artur Tumasjan)

Across the UK and around the world, billions of people have no access to financial services. These numbers swell when we go beyond 'the unbanked' to include 'the under-banked' - those that have only limited access to such services. Some people choose to limit their connections to formal institutions while others simply have no access.

However, nearly everyone has a smartphone or has access to one. Thus, a digital currency system would allow even people in remote areas access to financial services. We're not just talking about investing or saving money for retirement, either.

Around the world, calls are growing louder for a universal basic income (UBI). How will people receive their allotment if they have no access to financial services? You might think a debit card would fit the bill but that limits how people can put their UBI funds to work for them.

Besides, we hear ever more stories of debit and credit card scams. Not even they are safe to use, these days. However, even if someone steals your phone, they won't be able to access your accounts - but you could access them from any device. A government-backed CBDC may be the safest way to manage funds in the history of the pound sterling.

CBDC Pros and Cons

Centralisation and government control over individuals' private financial matters are two of CBDC naysayers' main points of contention. They emphasise that the government or the bank may freeze or seize your assets or limit how much you spend. They suggest that your payment app might not work if you shop in a store 'they' don't like.

But for the last one, these features are nothing new. Indeed, they've long been conditions under which we live our financial lives. Bank machines impose a daily withdrawal limit and you can't withdraw large sums from your accounts without the bank asking why. When we shop, bankers flag large purchases as a matter of course.

As for privacy in financial transactions, data collection practices let that horse out of the barn long ago. Financial institutions keep records of all your transactions, so that claim is also a needless worry. However unsavoury you may find these practices, they don't belong in the CBDC conversation. So what does?

Cutting out the middleman. Technology makes banks redundant; who needs a brick-and-mortar facility when you have access to financial management software? The Central Bank will become a true central bank. That means a lot of jobs lost, of course, but it also eliminates bank fees and operating costs.

People taking charge of their financial future is the most enticing promise of any CBDC project. You might, for instance, diversify your currency holdings; invest in a more powerful currency to hedge against an economic downturn. Converting currencies is one less thing you'll have to do when you plan your trip abroad!

Challenges CBDCs Face

Keep in mind that the digital sterling will not replace physical currency. In the UK, we plan for the CBDC to function alongside existing monetary units. That's to avoid burdening the elderly with too dramatic a change in our financial system. It hints at physical currency eventually phasing out but nobody said anything about that.

Getting everyone on the same page is one challenge to the CBDC rollout; this system is meant to be inclusive. How it will affect monetary policy and the financial system's stability are also major considerations.

Managing the amount of currency in the economy is the Central Bank's strategy for combatting inflation. That's one aspect of monetary policy; any CBDC project must plan a replacement control system. Cybersecurity also poses a challenge; hackers target critical networks all the time.

On the upside, international trade will be so much more efficient. CBDCs will make cross-border payments much easier, especially as these platforms will (likely) have currency converters built-in. Not only do CBDCs level the playing field for trade, but they also make finance more inclusive and easier for people to manage.

Around the world, several countries are in the trial phase of their CBDC rollout. China and Australia have initiated pilot programs for retail and wholesale CBDC. Nigeria officially launched their CBDC program in 2021, around the same time The Bahamas did.

North America and European countries' projects are either stalled or still in development. Who could fault them? The economic adaptations needed for a successful rollout are astounding in their complexity.

Summarise with AI: