"Tutoring is so fascinating. It's a fulfilling experience." -Chris Heacock

Are you looking for a job that is highly satisfying and that will leave you with the content feeling that you've done something worthwhile at the end of the day? If so, you might consider becoming a private tutor. Regardless of the topic that you know most about, there are most likely students out there eager to learn more!

Not only is private tutoring an engaging and diverse career, but it's also important to state that most personal instructors are in high demand. Whether in-person or virtually, individual tuition is becoming more and more popular because of its accessibility and convenience. Through private one-to-one education, persons have the opportunity to study a topic that they are sincerely passionate about in a comfortable, judgment-free zone.

Nonetheless, before carelessly changing your career path and becoming a personal tutor, it's worth mentioning that there are some critical steps to take before becoming a legally working tutor in the UK. So, without further ado, in today's article, we'll consider the required training and the tax framework to become a private tutor.

Find good tutoring jobs London here.

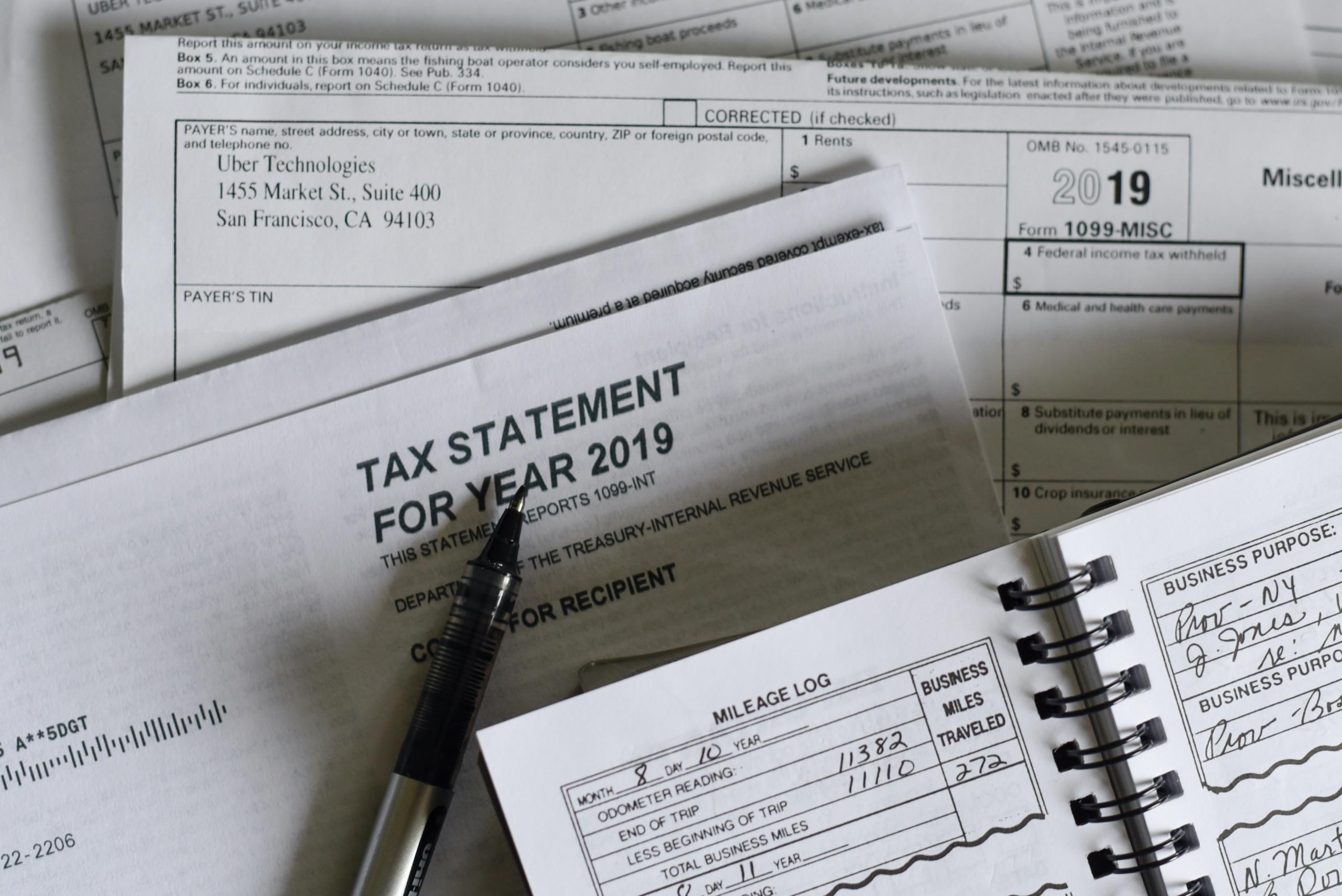

Turnover Declarations and Tax Framework for Tutors

Though it's never too enjoyable to tackle the nitty-gritty aspects of our jobs, we must all adhere to tax laws established by our country of residence. Knowing more about our taxes keeps things in check and prepares us mentally for any surprises when tax season arrives.

So, what about private tutors? What are the tax regulations established for personal educators? Well, before we mention tax frameworks, it's essential to discuss turnover declarations since they might be required for private educators working virtually or in-person across the United Kingdom.

Her Majesty's Revenue and Customs (HMRC) mandates turnover declarations for persons who are the proprietors of their own business or those who work for themselves and make a substantial profit throughout the year. A turnover declaration lets the government know how much the revenue is for a person or business and establishes the actual value of a person's insurable sales.

Search jobs for ex teachers on Superprof UK.

The HMRC uses turnover declarations to calculate the actual premium due for the previous year of taxes.

Self-employed persons, such as private tutors, are wise to claim their revenue to the HMRC so that they display their overall income to pay a tax that is neither too low nor too high. Also, self-employed workers are wise to fill out their turnover declarations since they may be eligible for any tax credits if their circumstances apply.

Additionally, it's worth stating that turnover declarations are similar to profits declarations because their overall purpose is to advise the government how much money a self-employed worker or a company has backed; this is entirely contrary to salaried workers.

New self-employed tutors are wise to educate themselves about whether or not they must fill out turnover declarations by the HMRC.

Now that we've established turnover regulations, what are the tax laws for tutors in the UK? First and foremost, it's essential to state that, like all working individuals, professional tutors need to pay taxes; you can't escape the man!

Private tutors working for themselves are self-employed workers. They need to pay a self-employment tax at the end of the tax year; this is different from salaried employees since their taxes are taken away after each paycheck. Tax forms for self-employed persons such as personal instructors can easily be found online.

Nonetheless, since first-time tutors might have a difficult time remembering how they should go about paying their taxes, we have provided the following list that features basic steps to adhere:

- Declare Your Self-Employment Income: all tutors, whether full-time or part-time, need to declare their income to the HMRC. Revenue can be reported using a form that is downloaded online. Creating and registering for your own "small business" is highly recommended since you are the sole trader working as a private tutor for others.

- Keep All the Papers: it's incredibly vital to keep all your receipts, notes, and invoices. By doing so, you ensure that you know how much money you earn as a tutor and how much money you spend on things for your self-employment business.

- Organise Documents: it's a wise idea to organise your documents in a folder not to get too lost when everything needs to be calculated at the end of the year. Consider getting a folder or electronic organiser.

- Read All the Information: to ensure that you are receiving all the necessary tax breaks, it's essential to read every document you are sent and check it over. As a self-employed tutor, you'll be better prepared to make intelligent financial decisions by knowing the rules and tax laws.

- Keep Track of Everything: to avoid missing any critical tax dates, past invoices from clients, and receipts that need to be sent out, you need to pay attention to everything. Some accounting software helps self-employed workers keep track of everything more easily.

By heeding all of the previously mentioned stages and steps, you'll make fewer mistakes when filing your taxes as a new personal tutor.

Also, to have successful moments paying your taxes, you might want to consider following tips such as asking friends for practical advice, hiring someone for assistance such as a tax tutor or accountant, and putting money aside each month to be prepared to pay for taxes.

Search tutoring jobs London on Superprof UK.

Whatever you're situation as a tutor might be, you need to pay your taxes and be aware of the rules from the start sets you on the right path and allows you to focus on the essential part of your job: inspiring the lives of your students through thoughtful teaching moments.

Find jobs for ex teachers here on Superprof.

What Kind of Training is Necessary to Become a Tutor?

One of the first things you might ask yourself before starting classes as a private tutor is, do I have the accreditations to begin working as a personal educator successfully? Knowing the answer sets you up for a fantastic career.

First of all, though most persons might consider working as a private tutor to make extra cash while attending university or to supplement their income, tutoring can be a full-time position. Some private tutors with recurring students can readily welcome five-figure salaries and enjoy fantastic teaching moments. But do they need to get certified?

While it's unnecessary to boast any specific accreditations or certifications to work as a private tutor, it's highly recommended to have some training. Many college students or proficient professionals teach tutoring sessions without accreditations, yet they usually have extensive knowledge of the academic discipline that they are teaching.

Nonetheless, if you're thinking of making a career out of private teaching, you'll want to adhere to the following list that mentions a few steps about how regular tutors can become certified:

- Finish High School: without a secondary school diploma, you couldn't educate others about academic disciplines.

- Complete Further Education: there are many different pathways to becoming a tutor; however, the most common requires finishing a Bachelor's degree in the topic you would like to teach. Also, tutor training may include familiarising yourself with their way of teaching and methodology for some tutoring companies, which may result in a tutoring certificate.

- Join a Tutoring Community: joining a tutoring community online as a tutor is a pathway to success. Therefore, to receive news, updates, information about networking events, potential tutoring certificates, or to find students, you'll need to join a tutoring site such as Superprof.

- Create a Profile: to start attracting students, you'll need to create a tutor profile. It's required to feature essential information such as experience teaching; qualifications received a profile picture, your availabilities, your rate per hour and, most importantly, the subject you can teach on your tutor profile.

By following the steps mentioned above, you have an easier chance of welcoming more prominent students who will stay with you for a while and who have deeper pockets.

Whether you have the accreditations or not, there is something that all tutors can work towards that doesn't require professional training. Like what? Honing skills. The list below mentions some abilities a tutor should have:

- Patience,

- A Positive Attitude,

- Tech-savviness,

- Empathy,

- Communication.

With the skills mentioned above, any tutor can quickly attract new students and have fantastic courses together. In addition, any person who loves to teach is passionate about the subject they are instructing and thoroughly enjoys people will thrive as a private tutor.

In conclusion, we sincerely hope that our informative article about how to become a tutor has inspired you to continue your journey to becoming a part-time or full-time academic instructor; you won't regret it!

Find teach English online here on Superprof.

Summarise with AI: